Good, ‘awful’ or could do better? Everything you need to know about OTAs

Hotel companies recognise the power that online travel agencies wield in the travel industry. They also need to know how these intermediaries monitor traffic, retain customers and manage to be top of mind for travellers in the early stages of the booking. EyeforTravel’s Ritesh Gupta takes a close look at some pertinent issues.

Hotel companies are constantly striving to improve the value proposition of bookings that take place on their sites. This isn’t easy especially with growing competition from online travel agencies (OTAs) and their clever approach to new devices, mobile apps, social networks and so on. So hotels simply can’t afford to overlook what they are doing.

A senior hotel distribution executive recently pointed out that the “cooperation with global OTAs is becoming increasingly more of a threat”. As important as it is to work out the best possible commercial negotiations, it is also imperative for hotels to not neglect their proprietary distribution channels.

Finding the balance and looking for value

The task of managing an appropriate combination of direct and indirect channels is expected to become complicated with increasing fragmentation, and hotel distribution executives are left needing to define what they are seeking from such partnerships.

“It is important to get the balance right. Make sure you are available where the customer wants to book, but you also need to ensure the value of being on different channels is worth it,” says Andrew Rubinacci, vice president, Distribution and Intermediary Sales, IHG, who believes optimising RevPAR net of costs (RevPAR minus distribution costs) is one way of checking if you are becoming more profitable.. “Where there is value, hotels will participate. When the value is diminished or changes, then the hotels will re-evaluate. I believe most people will make economically rational choices in the end.”

It’s often stressed that agencies are predominantly interested in capturing existing demand, and don’t do enough to generate new demand. Kurien Jacob, senior vice president, revenue and distribution, Highgate Hotels, disagrees, arguing that the focus is on both. “While OTAs capture existing demand, in my opinion the channel also generates incremental demand. The additional demand comes from marketing to their large database and marketing promotions that they do on their website and other channels,” he says.

OTAs falling short of expectations

However, it is fair to say that in general the industry expects more from OTAs. Chetan Patel, VP, Strategic Marketing & E-Commerce, Onyx Hospitality Group, believes OTAs could do better in promoting destinations. Most OTAs are active in the lower part of sales funnel but have less or nothing to say in the travel planning and booking phase. “If I am still at the planning stage, I am less interested in a particular hotel or flight. How can they help a consumer with more information on the destination, activities, events and more? How can they inspire travel where key selling point is not the price? Most OTAs do pretty awful job at these.”

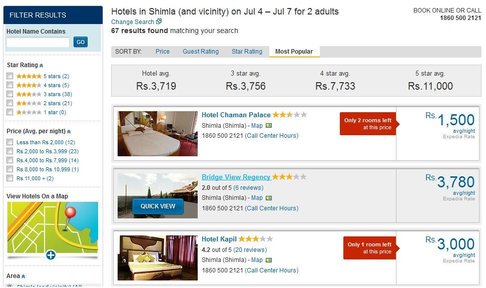

There is clear gap between what some hotel executives expect and what OTAs deliver. For example, if one clicks on Expedia’s India site, on the home page there is a segment, entitled ‘Holiday Ideas’. There are four sections under – Honeymoon, Family, Heritage and Weekends.

By clicking, one can view listings for cities, displaying a starting price and picture. From here on, the options are predominantly about hotel properties so the lack of content about the destination stands out. Perhaps OTAs don’t yet see a need for playing the role of an online visitor guide on their e-commerce sites, and are sticking to fulfilling booking needs.

What hotels need-to-know about OTAs:

1. Monetisation: Currently OTAs are looking to increase conversions from the traffic they generate, says Jacob. “This is more important than monetising the traffic. They make the most money in selling the core supplier products, such as hotel rooms,” says Jacob.

2. Retaining customers: OTAs are very focused on improving loyalty programmes and in addition, do provide a number of value add-ons to increase customer purchases and retain their customers, says Jacob.

3. Using technology to their advantage: Jacob agrees that OTAs are better equipped when it comes to changes in technology and marketing as that is what their businesses are built on. There is, as he goes on to express “a lag in suppliers adopting new technology which creates an advantage for the OTAs”. Recently, lastminute.com’s president Matthew Crummack mentioned that recent changes and future plans for technology are being driven by customers’ purchasing behaviour - they demand that the company’s platforms deliver speed and greater agility.

4. Inspiring customers: There has been much talk about going beyond commoditisation and instead inspiring customers to plan their next journey. Jacob says there is more talk than action in statements like: “OTAs inspire customers to plan trips”. “The money is in destinations where natural demand exists. Inspiring customers to take trips is a costly affair and will also need tremendous value offerings from suppliers. Hence the focus of OTAs will still be on destinations that have latent demand,” he says.

5. Targeting early part of the booking funnel: OTAs have mastered the art of acquiring customers in the latter part of the booking funnel, so for them growth opportunity exists in the early stage of the booking process. Jacob claims, they have “tons of money” to spend in acquiring these customers compared to hotel chains and suppliers.

Andrew Rubinacci, VP, Distribution and Intermediary Sales, IHG, and Kurien Jacob, SVP, revenue and distribution, Highgate Hotelsis scheduled to speak at EyeforTravel’s Travel Distribution Summit North America 2013, scheduled to take place at The Radisson Blu Aqua Hotel, Chicago (23-24 September).