Hotel websites’ share of bookings on the rise: report

A report has indicated that room nights booked through hotel websites last year grew consistently in each quarter, growing 6.8 percent in the fourth quarter compared to the same time in 2010.

According to data from the Fourth Quarter 2011 TravelClick North American Distribution Review (NADR), other distribution channels experiencing growth in the transient segment in the fourth quarter include: online travel agencies (OTAs), like Expedia and Hotels.com, and global distribution systems (GDS) used by travel agents, up 5.7 percent and 2.8 percent respectively. The report aggregates hotel bookings by channel for the transient travel segment (individual leisure and business travellers).

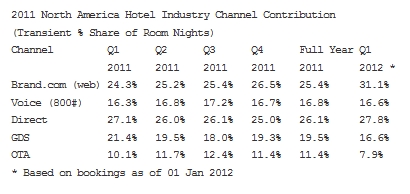

Overall in the transient segment, the OTAs accounted for 11.4 percent of all hotel rooms booked for the fourth quarter; GDS accounted for 19.3 percent; hotel websites (brand.com) accounted for 26.5 percent; direct bookings accounted for 25.0 percent; and voice, or 1-800 numbers, accounted for 16.7 percent.

During the 2011 calendar year, average daily rates (ADR) for the transient segment increased across all channels, up 3.8 percent compared to 2010, with rates for the OTA channel growing 9.8 percent and hotel websites up 3.5 percent.

For the fourth quarter specifically, ADR in the transient segment increased across all channels, up 3.7 percent, with rates for the OTA channel growing 9.3 percent and Brand.com up 2.5 percent compared to 2010.

Hotel companies have been focusing on educating customers about the value and benefits of booking direct on their websites. These companies have been investing in improving their websites and web value proposition to ensure hotels and customers understand and believe in the value of booking direct with them online.

As per the information available, consumers are spending an increasing amount of time shopping and comparing hotel options online, often visiting between 8-15 different websites to make an informed decision. Hotel companies’ goal is to capture maximum amount of that traffic and to ensure that page views result in booking clickthroughs or conversions.

Overall, hotels need to fully understand what all of the costs are in the first place in order to better manage their distribution costs and also focus on what levers they can pull to drive the right mix into their hotel at any given time.

“While a hotel’s website continues to drive more and more bookings for hotels, it is important to recognise that different channels cater to different types of customers, and having an appropriately diversified and optimal mix will drive improved revenue and profit outcomes,” said Tim Hart, executive vice president, enterprise services for TravelClick.