Pricing vs RM: how airline pricing is making a comeback

Do your tactics for pricing differ from how you implement inventory control? If not you could be missing out on new revenues, writes guest columnist Tom Bacon

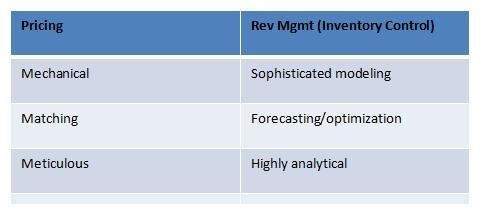

Who cares about pricing? At some airlines, pricing is a largely mechanical exercise, matching other airlines’ sale fares three times a day. This contrasts with revenue management – or inventory control (IC) - that exploits elaborate and highly sophisticated forecast and optimisation models, determining which fares are available and where sell-up occurs dynamically.

Doesn’t pricing basically require good organisational skills (managing a heavy volume of work and lots of data) and attention to detail (fare rules, ARC specifications) while IC requires greater analytical and business skills?

A short history lesson

Let’s take a look at the history of airline pricing and revenue management.

Historically, pricing has led RM in innovation – and, more often than not, RM works hard to keep up and to eventually exploit or leverage each change in pricing. Over the past five years, pricing has again led a seismic shift - that has yet to be fully captured by the RM folks.

Pricing saved the industry in 2008/09 – not RM. The industry quickly embraced new bag fees and higher change fees in response to record high fuel prices. RM couldn’t have done it alone in a marketplace of low fares and weak business demand.

Pricing is now the tool of choice for some of the most profitable US carriers - Spirit Airlines and Allegiant Air. Neither of these carriers is known for inventory control or improved demand forecasting and optimisation. In fact, both are mavericks in pricing. Yet many of the legacy carriers are watching them closely and have matched certain features. Both Spirit and Allegiant present new low fares to the marketplace that are not the result of mechanically matching the competition. And, because of their different fare and fee structures, it is often difficult to compare their all-up fares to the legacy carriers.

A view from the Gulf

In another example of the re-emergence of pricing strategy, I spoke to the director of an emerging Gulf carrier about its RM processes. He downplayed the role of inventory control and emphasised the need for pricing leadership in his highly competitive international markets – Gulf carriers compete against the major European carriers and the growing Indian and Asian carriers in O&D’s (origins and destinations) that cross the Gulf. He also emphasised that each O&D represents unique strengths and weaknesses of his carrier versus the competition. What is more, he avoided ‘matching’ other airline fares but instead looked to identify opportunities both for fare premiums and fare discounts that were consistent with the competitive positioning of his product.

And when responding to dramatic shocks in the market, pricing has much more leverage than inventory control. Fare increases of five to ten percent can be filed overnight -- totally overwhelming the estimated value of even the most sophisticated inventory control systems.

This is definitely the new era of pricing as it continues to pursue:

- New Ancillary Fees

- Branded Fares

- Customisation

- Distribution challenges

Both pricing and inventory control are valuable tools for airlines to maximise revenue but it is suboptimal to treat either too mechanically. Pricing innovations have, once again, dramatically changed the industry in the past five years – and pricing innovations continue at a fast pace. Once again, inventory control needs to catch up with pricing, as well as pursue its own innovations in forecasting and optimisation. Both pricing and RM continue to be prime opportunities for airlines to improve unit revenue.

Tom Bacon is an airline veteran and industry consultant in revenue optimization with 25 years experience. His views are his own. Questions? Contact Tom at tom.bacon@yahoo.com or visit his website http://makeairlineprofitssoar.wordpress.com/