Unwrapped: American’s New Fares

EyeforTravel’s guest contributor Tom Bacon was in charge of planning and revenue management at Frontier Airlines when it launched a branded fare menu back in 2008. Here he takes a look at the implications of a new merchandising scheme recently introduced by American Airlines.

In December, just before Christmas, American Airlines announced a new fare structure that effectively re-bundles certain a la carte ancillary services back into a new fare. So, for example, American is offering a free checked bag and a waived change fee for $34 more than the one-way ‘no frills’ fare which is subject to standard baggage and change fees. American is the first US airline to offer such a branded fare menu since Frontier Airlines launched a similar merchandising scheme in late 2008.

There is tremendous economic literature on ‘bundling’ and many airline consulting firms have written about how to optimise such re-bundling or ‘branding’. Considerations include merchandising and new sell-up opportunities, varying price elasticity of ancillary products, and segmentation and target marketing.

However, in addition to these, there are two additional aspects to USairline industry fare bundling namely competitive positioning and channel management. Let us consider each of these.

1. Competitive positioning.

Frontier’s and American’s offering are currently unique in the US market, effectively providing a differentiated product versus their competitors. Frontier needs to position itself against Southwest Airlines, an aggressive competitor in Denver. Southwest, of course, does not charge bag fees or change fees while Frontier generally matches Southwest on its lowest fares. In their branded fares, Frontier thus discounts the features Southwest provides for free – and further includes features that Southwest does not (more frequent flyer mileage credit and a lower charge for its more room product).

American will be able to differentiate itself against its largest competitors – United and Delta – with its branded fares.

2. Channel management.

American’s new fares are most easily accessible on the aa.com website. This is the least expensive distribution channel for American and offers greater opportunity to engage with customers. So, if American can move more customers to book directly as opposed to through the more expensive third-party channels, American can reduce its distribution costs. This was an explicit goal for us at Frontier – to reduce our reliance on third-party distribution.

Moving customers to the website is not straightforward, however. The greater flexibility inherent in the new fares (waived change fees) is targeted to business passengers who tend to book their travel through other channels. In some sense, branded fares represent a bit of a channel disconnect – most attractive to exactly those customers who wouldn’t normally have easy access to them.

Let’s quickly compare American Airlines’ approach with that of Frontier.

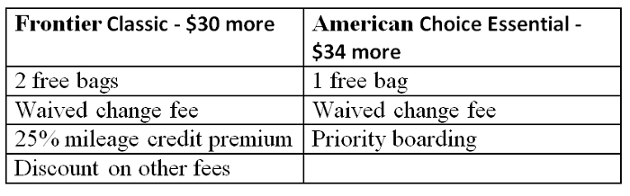

· The first sell-up point is similar.

Frontier attaches a $30 premium for its first branded fare; American charges an extra $34.

At Frontier, the purchase of Frontier Classic was initially highly correlated with checking in at least one bag. With bag fees of $20 per bag for the first and second bag, a customer who checks two bags gets $40 in value for a fare premium of $30; in addition, the waived change fee and the other benefits are free. Logically, almost no passengers bought the Classic fare if they weren’t checking a bag. For American, one checked bag is valued at $25 of the $34 fare premium.

Both bundles represent terrific savings for travellers who desire the flexibility of changing an itinerary (which would typically cost $50 on Frontier and $150 on American). Without these fare options, customers would need to pay a huge premium (a full fare ticket) to achieve this flexibility. Airlines do not offer such flexibility on an a la carte basis but presumably many travellers would be willing to pay $10 or more each way for such insurance.

Knowing where to differentiate

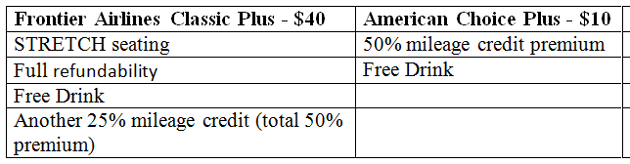

American has a quite different approach to its second bundle than Frontier. The second bundle is much more expensive for Frontier than on American. Frontier offers a $40 incremental charge for the second sell-up while American charges only $10.

American’s Choice Plus is very straightforward to evaluate. It is targeted to the business traveller who values frequent flyer miles. Through its AAdvantage programme, American charges $29.50 for 1000 mileage credit -- so a 50% premium on a 1000-mile flight could be valued at almost $15! A free drink is worth $6. Again, this should be very attractive (if the business traveller has easy access to these fares).

Frontier’s Classic Plus offers ‘full refundability’. This is hard to put a value on given that it isn’t sold a la carte – except via the full fare. On the other hand, if one can avoid change fees, full refundability is not generally critical for business travellers who are likely to be taking another trip in the next few months. However, Classic Plus also includes ‘stretch’ seating – Frontier’s more legroom offered a la carte at $15 per segment. Thus, for someone who would buy ‘stretch’ a la carte on a one-segment trip, Frontier offers a free drink and the 50% mileage credit (25% incremental). This amounts to the same as American Choice Plus - for an effective $40 minus $15 or $25 – not the most attractive proposition. Obviously Frontier believes some customers value ‘full refundability’ who are willing to buy full fares. However, historically, Frontier has sold few of these second sell-ups (the first sell-up is much more popular). So American, with its features and price point, is presumably expecting that its second sell-up will be more popular than Frontier’s has been.

It is terrific that American is launching its new re-bundled fares – good for American, good for travellers and good for the industry. The new fares represent technical and marketing innovation that is all too rare in the industry. I have little doubt that we will all watch these new fares and see more innovation and the industry learning in response.

EyeforTravel’s guest contributor Tom Bacon has worked as an airline executive and industry consultant in airline revenue optimization for 20 years. Questions? Contact Tom at tom.bacon@yahoo.com.