Why travel merchandising is an under utilised sales tool

Travel merchandising brings new upsell opportunities to the travel space. Guest columnist Tom Bacon takes a look at how to get another $5 from the customers

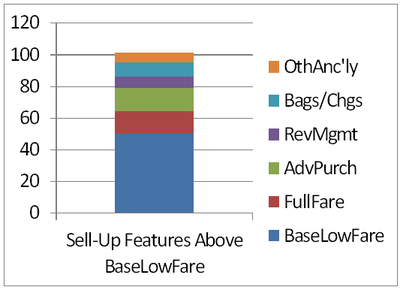

Airlines are already notorious for charging different fares to different passengers at different times. And now with new merchandising, airlines are broadening their upsell opportunities. So let’s review the different ways airlines achieve upsell:

1. Full fare versus restricted fares: The most fundamental sell up for airlines is offering a totally unrestricted ticket (‘full fare’) versus restricted fares (typically non-refundable). Since full fares can be multiples of the lowest fare, even if only five per cent of the passengers on a plane pay full fare it translates into more than a ten per cent increase in the average fare.

2. Advanced Purchase pricing: Breaking down restricted fares further, airlines typically institute various advanced purchase fare levels that increase as the booking comes closer to departure date. Typical advanced purchase dates are 21 days, 14 days, seven days and ten days. Other such rule-based upsell include round-trip, trip duration, and point-of-sale. In aggregate, these rules-based upsell structures increase average fares by another 10-15 per cent.

3. Revenue Management optimisation systems: With revenue management in place on each flight, airlines will close off lower fares, seeking upsell even within one advanced purchase (or rules-based) window. The lowest 21-day advanced purchase fare, for example, may be closed out 45 days in advance if demand is predicted from higher fare passengers. Managing fares dynamically with forecast demand is normally valued at an incremental five per cent in revenue (either in average fare or in additional passengers on low demand flights). Such revenue management is now considered essential for a successful airline.

These three sell-up features (full fare, advanced purchase and other rules, and dynamic revenue management) are established processes that have characterised airline pricing for decades.

True merchandising of these sell-up features, however, has been limited. With fewer than ten per cent of all passengers choosing to pay full fare and revenue management often overriding the advanced purchase windows, airlines don’t market these kinds of sell-up. Instead, the airline simply publishes the fare and the customer can either purchase the ticket today or be subject to, generally not known and often difficult to precisely forecast, fare increases going forward.

Of course, over the past five years, new sell-up opportunities have arisen with the introduction of new ancillary fees. These fees can be divided between bag/change fees, which account for the bulk of the new fees, and other ancillary:

4. Bag fees; change fees: Airlines applaud the institution of bag fees and change fees. Recently, it was reported that just these two kinds of fees totaled over $6 billion in revenue for US airlines in 2013 – accounting for much of airline profitability. Certainly, these are a result of new segmentation (do you need to check your bag or not?) and they represent an effective unbundling of previously bundled fares.

Bag fees and change fees, however, are still not so much focused on real merchandising or upsell marketing. Customers do have the choice to check bags or not and to change their tickets or not, but airlines do not really market these sell-up features - no airline offers: ‘Change your booking today -- for only $200!’

So when we talk of new merchandising opportunities for airlines – real ‘sell up’ marketing – we are talking about ‘other ancillary’ fees:

5. Other ancillary fees: Many airlines now offer fees for larger seats, priority boarding, onboard meals and Wifi, lounge access, expedited security and other optional services. In addition, there are third-party revenue opportunities as airlines market hotels, car rentals and events, and receive a commission on such sales.

As shown on the chart, ‘other ancillary’ still represents the smallest portion of airline ‘sell-up’.

Let’s review what this charts suggests:

Most of the airline revenue is based on pricing, not revenue management or merchandising. In fact, ‘revenue management’ and ‘other ancillary’ – which rely on sophisticated analytics and real merchandising - represent relatively small shares of total revenue and total ‘sell-up’. This is not to minimise their importance but instead to demonstrate that, given the structure of airline pricing, these operate more on the margin today.

‘Other ancillary’ is the real merchandising opportunity. These fees are a more explicit customer choice with, typically, somewhat smaller sell-up increments – they can be another $5 or another $30. These – and third-party revenue opportunities – require more sophisticated marketing that is still in its infancy at most airlines.

Summing up

A large and successful merchandising of ancillary fees could, at some point, disrupt the current mix of sell-up. Potentially, ‘other ancillary’ is a better way to segment the market than the current pricing structure which relies more heavily on advanced purchase and bag/change fees. Would a $79 passenger also purchase a meal, a hotel and an event in Las Vegas along with his flight? If so, potentially, the airline would no longer want to restrict availability of that $79 ticket in favor of later-purchased tickets. Potentially, ‘other ancillary’ could ultimately represent the largest sell-up tool for airlines.

Tom Bacon is 25-year airline veteran and industry consultant in revenue optimisation. Questions? Contact Tom at tom.bacon@yahoo.com or visit his website http://makeairlineprofitssoar.wordpress.com/