May 2019, London

Europe's biggest event for commercial and digital travel execs

Smart travel assistants: the new gateway for travel?

In the first of a two-part guest post, Roland Berger consultants outline a brief history of travel distribution and consider if smart travel assistants could be the new disruptors

Smart travel assistants provide an excellent cost-benefit ratio for travellers. For this reason, intermediaries and inventory providers must embrace these new capabilities to remain relevant for consumers.

Using AI-systems, mainly machine learning algorithms, and human-machine interfaces, such as voice recognition and chatbots, smart travel assistants are there to aid travellers at every step of the customer journey. While some smart travel assistants offer services to both business and leisure travellers, others are tailored toward specific traveller groups.

Through interviews conducted with three start-ups – Fineway, OKRoger and Claire – it emerges that the used cases of today's smart travel assistants are mainly focused on the planning and booking phase of the customer journey. However, it is likely that use cases will eventually expand to support travellers during the search, refining and experiencing phases. In order to determine whether smart travel assistants are the new gateway for travel, we must first examine the evolution of the global travel distribution ecosystem that has led to the current travel gateways.

Travel distribution – a brief history

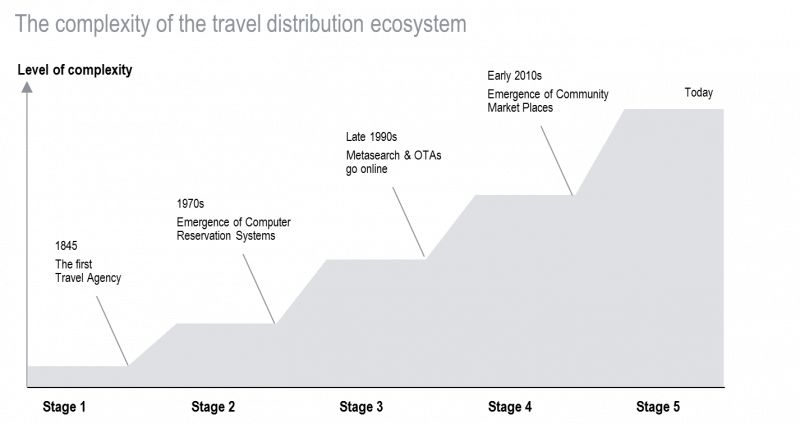

The travel distribution ecosystem has rapidly transformed in recent decades through five main development stages:

· 1 – No Intermediaries: In ancient times, travelling was characterised by direct supplier-customer relationships. Inventory providers such pensions, lodges or guides, supplied their respective inventory directly to the traveller, whenever one turned up. Given that travelling was mainly reserved for pilgrims and merchants, the number of travellers, and consequently, demand for professional travel services was low.

· 2 – Travel Agencies: This type of direct relationship between supplier and customer did not change until the first half of the 19th century with the arrival of a third party. Due to growing levels of disposable income, the demand for travel and for professional travel planning grew rapidly. As a result, the first group of local travel agencies were founded and these rapidly grew into national travel management companies and tour operators. From this point onwards, travellers no longer had to gather information about available inventory or plan the journey by themselves.

· 3 –Global Distribution Systems: More than a century later, the rapid developments in information and communication technology (ICT) fuelled the transformation of the distribution ecosystem into a four-party system through the invention of computer reservation systems (CRS). CRS did not offer a service directly to travelers but provided a valuable service to travel agencies by delivering fast and easy access to inventory and pricing data. Initially, an offering invented by major airlines to distribute flights, it was not long before CRS offered more inventory choices, expanded globally and were rebranded as global distribution systems (GDS).

· 4 –Metasearch & OTA: The fifth party to the travel distribution ecosystem was introduced in the late 1990s when the newly invented World Wide Web provided an opportunity for online travel agencies (OTAs), as well as metasearch and review sites. These websites offered travellers access to comprehensive information about inventory that was previously exclusive to travel agencies. Consequently, self-service travel booking and managing became increasingly popular.

· 5 – Community marketplaces: Recently, community marketplaces such as Airbnb and BlablaCar have established themselves as the sixth player in travel distribution systems. They have led to a major shift in the travel sector by providing access to formerly private inventory such as apartments and cars. By gathering and distributing information about available travel inventory, they mirror global distribution systems. However, in contrast to GDS, which sell their services exclusively to travel agencies, community marketplaces sell inventory directly to travellers.

Currently, smart travel assistants are looking to become the newest members of the travel ecosystem. Reflecting on previous developments, every new party was able to add value to the system by means of increasing accessibility, transparency or convenience. In order to evaluate if smart assistants can be the new gateway for travel, it is crucial to examine their added value, which we do in Part II.

This guest post was contributed by Roland Berger consultants JoergEsser Rafael Geisler and Stephan Hundertmark. Esser, who spent over 10 years in the travel industry in various roles at Thomas Cook, will be moderating a session at the upcoming EyeforTravel Digital Strategy Summit (May 21-22)