The end of the rate-matching machine: ways to count on competitive pricing

Competitive pricing is an element of pricing decisions in any market. How this is done depends on the availability of such data to providers, the visibility and comparability of it to customers and the level of fragmentation in the market.

In hospitality and travel, thanks largely to broad Internet distribution, all of these factors make competitive pricing particularly important. This is especially so for hotels, where the market is most fragmented. For hotels the upside of this, however, is that competitive data is so readily available. Vendors offer both forward-looking rate information, as well as backward-looking performance (revenue and occupancy) information. The negative side of this is that the revenue manager can easily be pulled into reacting only to competitive information – and becoming what I like to call a ‘rate-matching machine’. The problem with rate-matching machines is that they ignore the most important factors that revenue managers should be thinking about: demand and remaining capacity, and how these compare to each other.

Here EyeforTravel’s Ritesh Gupta talks to Alex Dietz, principal product manager, SAS about competitive pricing.

EFT: How can competitive pricing prove its worth to RM executives if done properly?

AD: Let’s start with knowing when you aren’t using competitive pricing information properly. The most tell-tale evidence that you might be using competitive pricing information properly is your reaction to the condition where you are priced above your competition. If your reaction to this is “we’re not going to get any demand!” it is a virtual certainty that you are not using competitive information properly. If your reaction is “we’re going to see less demand,” then at least you are on the right track.

Remember: customers are diverse, they make their decisions on a variety of factors – including price. Think of it as the value versus price scale – but just remember that different customers judge value and price differently. As a result, there’s a continuum that represents the “tipping point” for price versus value – this is what we’re talking about when we talk about price elasticity of demand.

Modern analytic techniques make it possible to measure price elasticity – not only as an isolated factor, but as a competitive effect as well.

EFT: Can you expand on this?

AD: In other words, analytics are not only capable of answering the question “What if we charge $99 instead of $119?”, but also “What if we charge $99 instead of $119, while our competitors are charging $119?” and other such variants. If we combine that sort of thinking, along with an analytical take on how demand compares to available inventory (i.e. “Given that we only have 50 rooms left to sell, and given that our competitors are charging $X, could we make more money by changing our rate”) – then we are really getting to what modern pricing and revenue management should be.

EFT: Can you explain what analytics of competitive pricing means?

AD: In travel and hospitality, competitive pricing analytics is primarily focused on the impact of a property’s competitors’ pricing on that properties demand – statisticians would refer to this as “cross price effect” or “cross price elasticity”. Another application for pricing analytics is anticipating amount and timing of competitors’ reactive price changes (i.e. “if I change my prices, what are the chances that my competitor changes their price – and when and by how much?”).

The purpose of this sort of analytics, of course, is to inform intelligent pricing decision-making, especially in the form of automated revenue management systems. Unfortunately, traditional revenue management science doesn’t easily adjust for competitive effects – so one needs to look into other types of analytic approaches to include these effects.

EFT: SAS believes that in situations where revenue managers actively adjust prices in response to changes in expected future demand, standard modelling techniques can lead to significantly biased estimates of price elasticity. What does this mean?

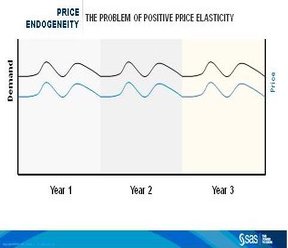

AD: Yes, in statistics, this phenomenon is referred to as price endogeneity. The problem is caused by the revenue manager anticipating demand and adjusting prices accordingly. So, for example, in low season a revenue manager will lower prices, while in high season the revenue manager will raise them. If this pattern is repeated, we would expect to see a stream of historical data that would look something like the chart below – demand appearing to rise when demand is high, and demand appearing to drop when price is low.

This is, of course, perfectly good business – it just happens to confound standard analytic approaches, such as regression. You see, we are interested in the impact of price on demand, but before we can look for this effect, one needs to remove the causal relationship that exists in the other direction – where anticipated demand is impacting price selection (by the revenue manager). If we do not account for the endogeneity, and simply try to run a regression against this data, our analysis will reveal positive price elasticity – indicating that our demand will increase if we increase our prices. If we fed that information into a revenue optimisation model, our model would always choose the highest price – clearly the wrong choice.

Interestingly, the availability of competitive pricing information is useful in dealing with price endogeneity. As a result, to a hotelier, competitive pricing data not only provides benefits in terms of recognising the impacts of demand from competition, but also in improving the accuracy of the impacts of our own price changes on demand.